Now that the collapse in oil prices is causing our state to be headed in the same direction as the rest of our nation, when will our new governor participate in a nationwide conference of governors on the subject of selling state, municipal and port authority infrastructure bonds directly to the United States Federal Reserve?

We currently live in a time when the ideas taught to the employees and subjects of the old British East India Company and British Empire are once again dominating our educational and political institutions. These “Classical Economics” ideas and their controlled opposition currently prevail in most of our discussions and budget-cutting austerity is now the consensus among leading policy intellectuals.

There is another way out of this mess and the solution is in your wallet. Take out a ten-dollar bill and recognize Alexander Hamilton. Hamilton is on the ten-dollar bill to remind future generations that our nation returns to his economic and credit creating policies when our nation faces danger.

Alexander Hamilton’s American System of political economy was used to successfully mobilize for the American Civil War, World War I, and World War II. Our nation does not face an immediate military adversary today but the danger to our nation is very real now that the quadrillion-dollar derivatives bubble is beginning its inevitable collapse.

After decades of declining investment into infrastructure and productive capacity our nation is now in the grip of a financial capital strike caused by the deregulation and wide spread criminality in financial derivatives. All increases in the United States money supply that should go toward agriculture, industry and infrastructure are now subsidizing the parasitical financial derivatives that have effectively caused a capital strike.

So how is this capital strike to be ended in order to restart our economic system?

The United States Constitution clearly states that Congress shall coin and regulate our money but I seriously doubt that institution will lead a workable reform. Our Congress seems to be trapped in the never-ending partisan gridlock of debating the controlled opposition ideas of the old British East India Company “Classical Economics.”

Our President could order the reform of the Federal Reserve consistent with the reforms of President Lincoln or FDR but that is also unlikely with our current President.

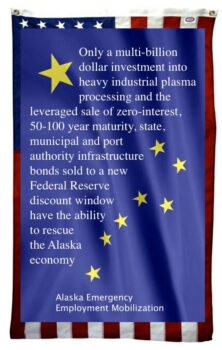

A more realistic potential for reform is for a group of state governors to demand the creation of a new Federal Reserve discount window for zero-interest, 50–100 year maturity infrastructure and productive capacity bonds. This is possible because several state governors together have the ability to speak to our entire nation, including our power elite, in a way that is not possible with our current President.

I believe a good national discussion about practical Hamiltonian financial solutions will have the tendency to force the power elite to curb some of their self-destructive derivatives contracts. Eventually some financial criminals will end up serving prison time but generally those who participate in the new bond system will be spared the collapse of their portfolios and will survive the storm.

Some people say that the criminality of our financial system is so endemic that only the incarceration of large numbers of financiers will solve the problem. But even if a large number of financial criminals were put in prison there would remain the root problem of collapsing financial credit for the physical production of agriculture, industry and infrastructure due to the massive gambling in derivatives on a global scale.

Let us discuss one root of the capital strike problem by offering the solution of state infrastructure bonds purchased by the United States Federal Reserve. The Federal Reserve is running out of policy options and there is a general recognition that the financial derivatives bubble will inevitably self-destruct in a way that causes horrific human suffering. A practical workable solution must be put on the table now.

Our new governor can be part of the solution for our entire nation. His advisors should put together a team for the creation of state and privately leveraged 10 billion dollar per year Alaskan bond packages that mandate a minimum 50–90 percent Federal Reserve participation. If you know of a reason why one of these parameters is not efficient please contact this author immediately.

Now is the time to take another look at that 10-dollar bill and consider the potential for our new governor to think outside the ideas of Classical Economics by using the local decision making process of bonding to begin a science and infrastructure-led recovery.

Alaska’s new governor was elected in a way that is special to our nation and his future legacy and potential for re-election will be determined by his strength in offering solutions that reject budget cutting austerity.

There are workable solutions rooted in the economic history of our nation and Governor Bill Walker has the unique opportunity to ride the wave of financial reform while creating the potential for his national leadership.

His successful leveraging of zero-interest Federal Reserve bonds with interest bearing private bonds and state bonds will not only revive the Alaskan economy but most important, will set the stage for all other states to begin participation in Federal Reserve bond sales.

Our new governor will create his position in future history and will have demonstrated his re-electability as governor and possible leadership position as President of the United States.

Click like to help Bill Walker become President of the United States.